Cryptocurrency: the digital gold rush that turned broke dreamers into Bitcoin billionaires overnight. But what happens when a get-rich-quick scheme turns deadly? Grab your popcorn (and maybe your hardware wallet), because this tale has everything — greed, betrayal, and a plot twist straight out of a Hollywood thriller.

The Rise of Crypto and the "Too Good to Be True" Scheme

Cryptocurrency has always attracted a certain kind of person: tech enthusiasts, risk-takers, and, let’s face it, scammers with a Wi-Fi connection. In the wild west of digital finance, it was only a matter of time before someone combined crypto with the age-old pyramid scheme.

What Is a Crypto Pyramid Scheme?

A crypto pyramid scheme is the unholy marriage of blockchain and multi-level marketing (MLM). Here’s how it works:

-

The Hook: Promises of astronomical returns (“Invest $100 today and earn $10,000 next week!”).

-

The Structure: Early investors make money by recruiting others. The catch? New recruits’ investments fuel the payouts.

-

The Collapse: When recruitment slows, the house of cards comes tumbling down.

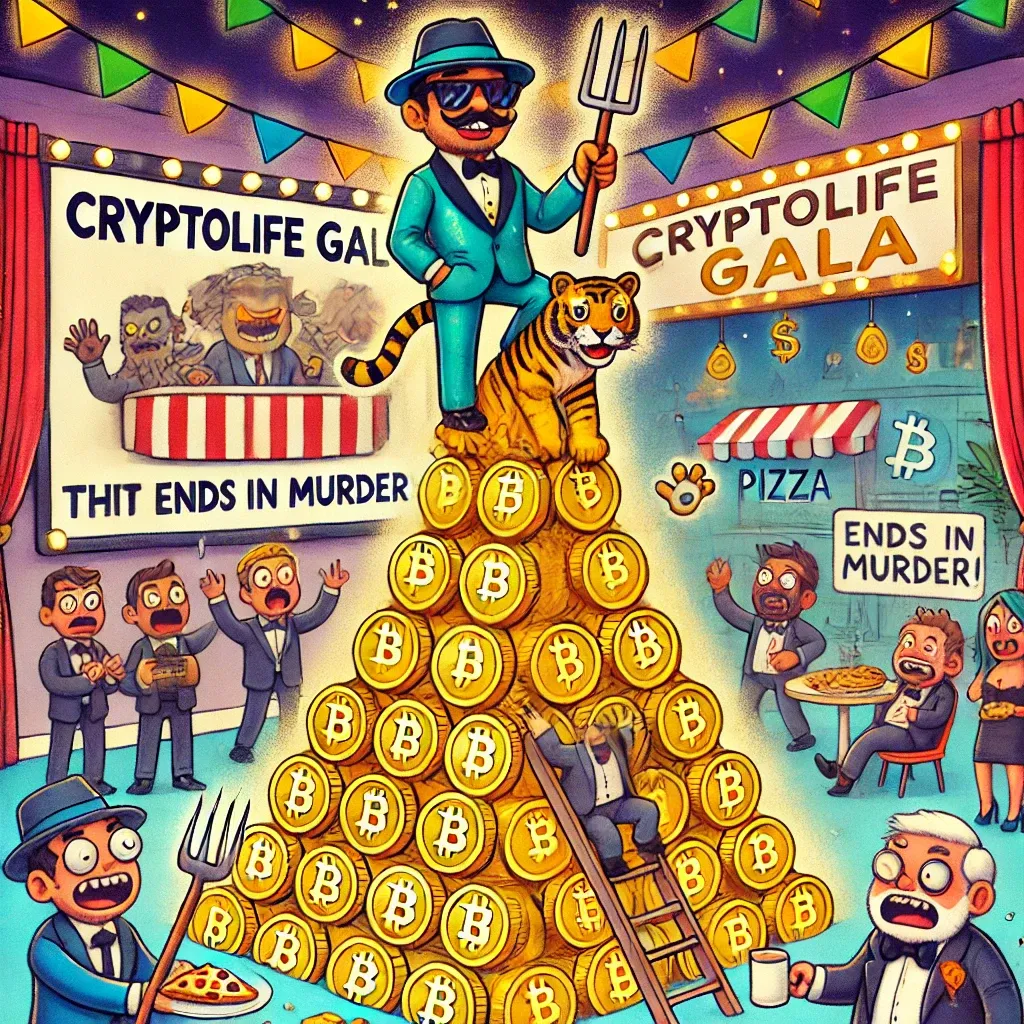

Enter our villain of the story: "CryptoLife," a so-called investment platform that promised riches but delivered... let’s just say, less-than-ideal outcomes.

The Mastermind: From Visionary to Villain

Every pyramid scheme needs a charismatic leader. For CryptoLife, that leader was Kevin "Crypto King" Sanders, a former door-to-door vacuum salesman turned self-proclaimed blockchain guru. Armed with motivational speeches and a white paper so vague it could have been written by a Magic 8-Ball, Kevin built an empire of gullible investors.

The Warning Signs Everyone Ignored

-

Red Flag #1: The company logo was a literal pyramid.

-

Red Flag #2: Kevin often referred to investors as his "downline army."

-

Red Flag #3: The office location? A co-working space above a pizza shop.

The Fall: When Greed Turns Lethal

As CryptoLife’s investor base grew, so did Kevin’s ego. He began living the high life: luxury yachts, diamond-studded crypto wallets, and a pet tiger named Satoshi. But as the payouts slowed, the pitchforks came out.

The Turning Point

One fateful evening, Kevin hosted a "CryptoLife Gala" to reassure nervous investors. Unfortunately for him, the open bar only fueled the mob’s anger. Amid the chaos, Kevin disappeared. Weeks later, his body was discovered in the most ironic way possible: buried under a pile of devalued Bitcoin USB wallets.

Lessons Learned (With a Side of Sarcasm)

If this story teaches us anything, it’s that greed and gullibility are a dangerous mix. Here are some takeaways to avoid ending up in your own crypto crime drama:

How to Spot a Crypto Scam

-

If It Sounds Too Good to Be True, It Is: Nobody’s turning $10 into $10 million overnight. Unless they’re robbing a bank.

-

Check the Tech: If the platform’s blockchain can’t explain itself, run. Fast.

-

Beware the Cult of Personality: If the CEO looks like they’re auditioning for a Netflix documentary, it’s a no-go.

What to Do If You’ve Been Scammed

-

Call the Authorities: Seriously, don’t try to take justice into your own hands.

-

Join Support Groups: You’re not alone. Plenty of people have been duped by crypto charlatans.

-

Learn From the Experience: And maybe stick to index funds for a while.

The Final Word: Comedy or Tragedy?

The story of Kevin "Crypto King" Sanders is both a cautionary tale and a dark comedy. While it’s easy to laugh at the absurdity, it’s also a reminder of the very real consequences of unchecked greed. So the next time someone pitches you the "next big thing" in crypto, just remember: if there’s a pyramid involved, it’s probably best to pass.